Simplified Bookkeeping for Flower Farmers

You know that feeling you get when you take that freshly opened box of seed packets and dump it out on your bed, spending the night dreaming about the gorgeous flowers you’re going to grow?It’s almost like a scene from a heist movie where the thieves stare at a pile of cash on a table. Except, in this case, it’s seeds, and you’re already dreaming of their transformation into blooms.

Now, here’s the part that doesn’t exactly inspire the same kind of giddy excitement: bookkeeping. It’s not glamorous, but it’s critical to keeping your flower farming business blooming. Bookkeeping helps you monitor your farm’s financial health, make informed decisions, and even get a little more joy out of those spreadsheets (okay, maybe just satisfaction, not joy).

In this blog, we’ll break down bookkeeping for flower farmers step-by-step, focusing on practical tips and methodsto make the process less daunting. By the end, you’ll feel more confident keeping tabs on your business finances, so you can spend less time crunching numbers and more time planting dreams.

Before diving into bookkeeping specifics, let me introduce myself properly. I work in the accounting field by day and help Jessica run our flower farm on weekends. I’ve spent over a decade working with small business finances and several years in the trenches of flower farming.

If you’re wondering why this combination matters, it’s because flower farming, like any small business, benefits from good bookkeeping—with a few unique quirks. My goal is to share insights from our experience that are tailored to this industry, while still grounded in sound financial practices.

Bookkeeping isn’t just about taxes (though that’s part of it). It’s about keeping a pulse on your business, making better decisions, and preparing for growth.

Ready to get started? Let’s dig in.

Harvesting Rock Run Ashley dahlias to encourage more blooms—just like staying on top of bookkeeping ensures your flower farm keeps thriving.

What is a Sole Proprietor?

A Sole Proprietor (Sole Prop.) is the default business entity for any single-owner business unless you officially register something else, like an LLC, S-Corp, or C-Corp. If you’re starting your flower farming journey, chances are this is your current setup—or will be—because it’s simple, straightforward, and doesn’t require a lot of extra paperwork or fees.

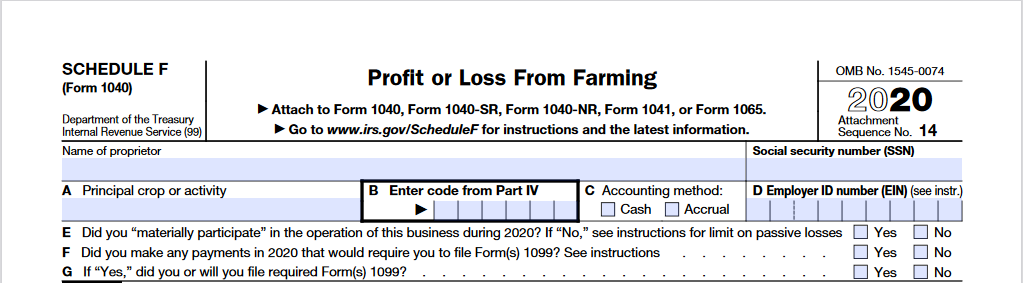

As a Sole Prop., you report your business activity directly on your personal tax return using a Schedule C or, for farmers, a Schedule F. This simplicity often makes it the best choice for first-year flower farmers since it lets you focus on building your business without jumping through legal hoops.

Here’s why Sole Prop. works well for most new flower farmers:

Easy to set up: (Hint: You may already be one without realizing it).

Offset income with losses: Losses from your flower farm can offset other income on your tax return, which might come in handy during the early years.

Room to grow: It allows you to build your business before considering more complex legal structures.

However, it’s not a one-size-fits-all solution. There may be situations where an LLC or another entity type better protects your assets or offers tax advantages. A quick chat with your CPA can help you decide what’s best for you as you move forward.

Want to learn more about entity selection? Check out our blog here.

Get a Dedicated Business Bank Account

This isn’t just a suggestion—it’s a game-changer. A dedicated business checking account simplifies bookkeeping, keeps your finances organized, and reinforces your professionalism. Think of it as creating a clear boundary between your business and personal life—a boundary that benefits both.

Compliance Benefits:

Having a separate account can save you headaches during audits or reviews. When personal and business transactions are kept apart, it’s easier to provide clear records and demonstrate compliance with regulations.

Budgeting and Financial Insights:

A dedicated account also makes it easier to track income and expenses, helping you stick to your budget and make informed financial decisions. At a glance, you can see how your business is performing without wading through irrelevant personal expenses.

Credibility with Customers and Vendors:

A business account adds legitimacy to your operation. Paying vendors or receiving payments through an account with your business name on it shows that you mean business—literally. It’s a small but impactful way to foster trust and professionalism.

It’s easy to set up:

Register your business name.

Get a fictitious name certificate if required.

Open a business checking account under your name and your business name.

That shiny debit card with your farm’s name on it? It’s not just a cool perk—it’s a practical step toward running a professional operation.

With your business account in place, it’s time to talk tools—specifically, bookkeeping software to help you keep everything organized.

Embrace Modern Ledgers: Importance of Bookkeeping Software

Bookkeeping software might not be the most exciting part of running a flower farm, but it’s a cornerstone of keeping your finances organized. The right tools can save you time, reduce errors, and provide the insights you need to make sound business decisions.

A Practical Look at QuickBooks Online

QuickBooks Online (QBO) is a widely accepted option for small businesses. While it’s not perfect, it’s functional and accessible. If you’re just getting started, the basic plan is all you need.

Manually entering transactions gives you more control and accuracy than relying too much on automation, which can sometimes create unnecessary complications. While features like automated bank feeds and categorization rules sound appealing, they can lead to errors that take time (and money) to fix. Staying hands-on with your data ensures that your records reflect the reality of your business.

Why Use Software at All?

Bookkeeping software helps you:

Organize your financial data in one place.

Easily create reports like your Profit & Loss (P&L) and Balance Sheet.

Streamline tax preparation, making it less of a headache.

Even if you prefer manual processes, software like QBO provides a more efficient way to track your finances compared to spreadsheets or paper ledgers.

Work with Your CPA

Before committing to any bookkeeping software, consult your CPA. Many accountants prefer specific programs, and aligning with their expertise can make tax preparation smoother. The goal is to choose a tool that works for both you and your accountant.

Alternatives to QuickBooks

If QuickBooks isn’t the right fit, consider these options:

Xero: Known for its ease of use and good for managing inventory.

Wave: A budget-friendly (free) choice for basic bookkeeping needs.

Manual Systems: Spreadsheets can work for smaller-scale farms, as long as they’re well-organized and detailed.

With your bookkeeping software in place, it’s time to structure your financial records effectively. Up next: how to set up a Chart of Accounts tailored to flower farming.

Carefully harvesting Nuance Italian ranunculus—just like tending to finances, attention to detail ensures lasting success.

Chart of Accounts: Organizing Your Financial Data

A Chart of Accounts (CoA) is the backbone of your bookkeeping system, helping you organize all financial activity into categories. For flower farmers, it’s essential to tailor your CoA to reflect the unique aspects of your business, from seeds and soil amendments to wedding florals and subscriptions.

Why the Chart of Accounts Matters

Think of your Chart of Accounts as a filing cabinet. Each account represents a drawer, keeping specific types of transactions organized and easy to access. This structure simplifies:

Tax Preparation

Financial reporting

Day-to-day management of your business finances

Avoiding Common Pitfalls with Chart of Accounts

While it’s tempting to create detailed accounts for every seed variety or sales channel, overloading your CoA with excessive sub-accounts can make it cluttered and difficult to interpret. Instead, focus on broader categories that cover essential areas of your business.

For example:

Simplify: Use one account for "Seeds & Plant Materials" instead of separate accounts for each flower variety.

Use Software Tools: Class Tracking in QuickBooks can help you track details like wedding versus farmer's market sales without adding unnecessary accounts.

Basic Chart of Accounts for Flower Farmers

Income Accounts:

Flower Sales

Workshop & Event Revenue

Subscription Revenue

Cost of Goods Sold (COGS):

Seeds & Plant Materials

Soil Amendments

Floral Supplies (e.g., vases, ribbons)

Expenses (General & Administrative):

Advertising & Marketing

Business Supplies

Utilities

Dues & Subscriptions (e.g., ASCFG memberships)

Assets:

Equipment & Machinery

Vehicles

Prepaid Expenses (e.g., bulk seed orders for next season)

Liabilities:

Loans Payable

Credit Cards

Equity:

Owner’s Contributions

Retained Earnings

This list is not exhaustive but provides a strong foundation. As your business evolves, your CPA can help refine it further. Remember, keeping your CoA simple and organized will make financial management much more efficient and stress-free.

Using Your CoA Effectively

Every transaction should be categorized under the appropriate account. This ensures your P&L and Balance Sheet reflect accurate data, helping you assess your farm’s financial health and pinpoint areas for improvement.

To make the setup even easier, download our free Chart of Accounts template, designed specifically for flower farmers. It’s a streamlined starting point that saves time and frustration.

Choosing Your Bookkeeping Method

Finding a System That Works for You

By now, you’ve set up a business bank account, organized a Chart of Accounts, and chosen your bookkeeping software. Now it’s time to dive into the nuts and bolts of tracking your financial transactions.

There are two primary methods for bookkeeping:

1. “After the Fact” Bookkeeping

With this approach, you rely on monthly bank and credit card statements to input all your transactions at once. It’s efficient for busy flower farmers but less helpful for making real-time decisions about your business.

2. “As it Happens” Bookkeeping

This method involves recording expenses, income, and other transactions as they occur. It ensures your financial data is always current and helps you make informed decisions throughout the year.

While “As it Happens” offers the most accuracy and timeliness, it also demands consistent effort—a tall order during the hustle and bustle of peak growing season.

Our Hybrid Approach

If you’re like most farmers, your time is in short supply—especially when the days are long and every spare minute is spent tending to crops. That’s why we recommend a hybrid approach:

During slower months: Keep up with your books “As it Happens” for the most accurate and up-to-date information.

During busy months: Shift to “After the Fact” and tackle bookkeeping in batches when the season winds down.

Here’s the real kicker:

The hybrid approach allows flexibility without sacrificing accuracy. By maintaining good records in the off-season, you’ll have a solid foundation to work from when you switch gears to catch up during busy times.

For us, this balance meant we didn’t have to let bookkeeping fall completely by the wayside, but we also weren’t losing sleep trying to track every expense during harvest.

Practical Tips for Transaction Entry

No matter which method you choose, entering transactions is straightforward when you break it down. Think of it like maintaining a check register—just with a bit more detail:

1. Assign Each Transaction to an Account

Use your Chart of Accounts to categorize each transaction properly. If you’re unsure, take a moment to review your options—consistency is key!

2. Stay Organized

Even with “After the Fact” bookkeeping, keep receipts and invoices in one place. Consider using an app or folder to save electronic receipts for easy reference. Along with the receipts, always defer back to your bank statements (the business bank account is paying off already!).

3. Review Regularly

Set aside time to double-check your entries, especially if you’re catching up after a busy period. This habit helps catch errors early and ensures your reports stay accurate.

The Biggest Hurdle: Classifying Expenses

The biggest hurdle in bookkeeping is learning how to classify expenses. It can feel overwhelming at first—like trying to remember the name of every flower variety you grow—but it becomes second nature with practice.

And remember: mistakes are fixable. Even if you misclassify that $1,000 dahlia tuber order, it’s easy to correct later.

Now that you know how to record transactions efficiently, let’s explore common pitfalls and mistakes to avoid—so you can keep your books as beautiful as your blooms.

Avoiding Common Bookkeeping Pitfalls

Even with a solid system in place, there are a few common traps that can throw your books off balance. Avoiding these will save you time, headaches, and potentially a call to your CPA with an embarrassed, “I think I messed up.”

Keep It Clean

Use the Right Register

Always ensure you’re in the correct account register when entering transactions. For example, don’t log a credit card purchase in your checking account register—it’s a surefire way to create chaos.

Categorize Large Purchases Correctly

Significant investments like vehicles, equipment, or greenhouses belong in Fixed Asset accounts, not your Profit & Loss (P&L) accounts.

For example:

That new walk-in cooler? It’s not an expense—it’s an asset. Log the purchase under "Machinery & Equipment" and any depreciation separately.

Handle Loans Properly

Any loans you take out should be logged under a Liabilities account. Only record interest payments as expenses on your P&L; the principal goes against the loan balance in your liabilities.

Hands-Off Equity Accounts

Think of your equity accounts like the Mona Lisa: admire them, but don’t touch. These accounts track what’s invested in or earned by the business over time—not day-to-day activity.

Stay Vigilant

Even small errors can snowball into big problems if left unchecked. Here’s how to stay on top of things:

Reconcile Accounts Regularly

Match your records to your bank and credit card statements monthly to catch discrepancies early.

Separate Personal and Business Finances

Keep your business and personal transactions completely separate—yes, even for that quick coffee run during a supply pickup.

Ask for Help When Needed

If something doesn’t make sense, don’t guess. Reach out to your CPA for guidance—they’re there to help, not to judge.

Now that you’ve sidestepped these potential bookkeeping blunders, it’s time to dive into understanding the reports that give your flower farm financial clarity: the Profit & Loss and Balance Sheet.

Understanding the P&L and Balance Sheet

Now that your books are organized and your transactions are logged, it’s time to dig into the real gold of bookkeeping: financial reports. The Profit & Loss (P&L) and Balance Sheet are your best tools for evaluating your flower farm’s financial health and planning for the future.

Think of them as the highlights reel and the team roster for your farm’s finances.

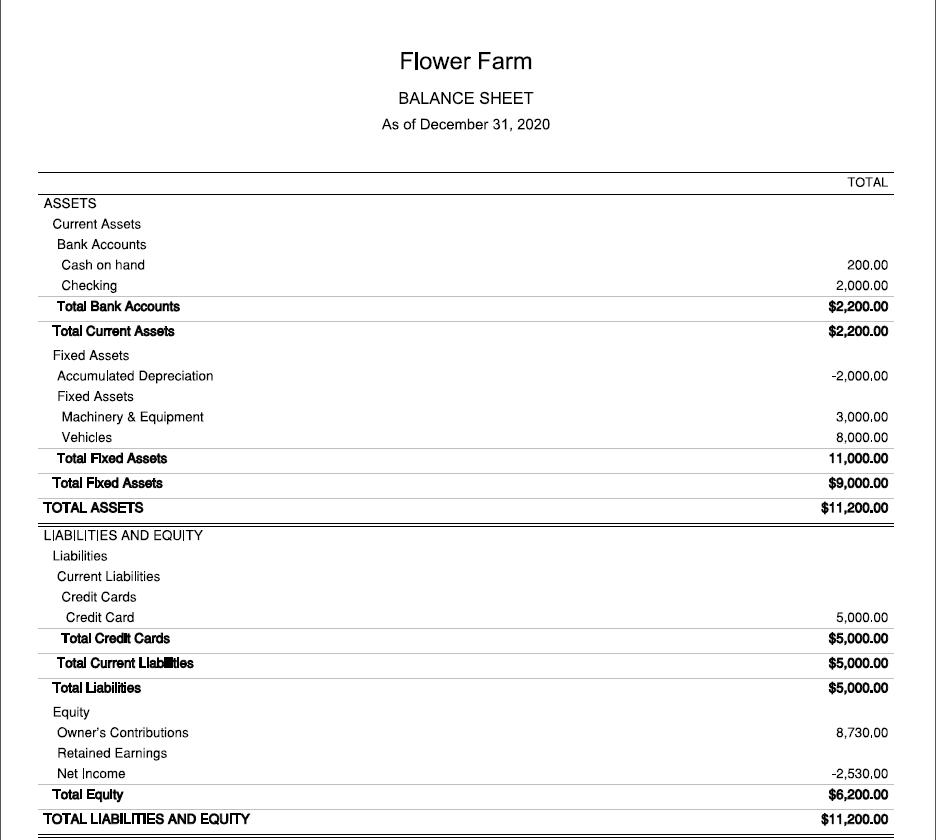

Balance Sheet: The Big Picture

While the P&L shows activity over time, the Balance Sheet provides a snapshot of your farm’s financial standing on a specific date, often the last day of the year. It’s divided into three key sections:

1. Assets

What your business owns. Examples include:

Cash in your business bank account.

Equipment like greenhouses or tools.

Prepaid expenses, like seeds for the next season.

2. Liabilities

What your business owes. Examples include:

Loans for farm expansions or purchases.

Credit card balances from purchasing supplies.

Unpaid invoices or other obligations.

3. Equity

The owner’s stake in the business, or what’s left when liabilities are subtracted from assets. It’s the "what do I have to show for it" number.

Why Does It Matter?

The Balance Sheet provides critical context for your P&L. For example:

Your P&L might show a great profit, but if your Balance Sheet shows significant liabilities, your financial health could still be shaky.

Conversely, a strong Balance Sheet with growing equity shows that you’re building a solid financial foundation, even if profits fluctuate seasonally.

A Quick Example: Balancing the Two

Let’s say your P&L shows a net income of $20,000 for the year. That’s exciting! But your Balance Sheet reveals that you have $25,000 in unpaid loans.

While your farm operations are profitable, your debt means you need to prioritize repayments before making major investments.

Why This Matters

Knowing how to read these reports gives you powerful insights into your flower farm’s financial health. But remember, reports are only as good as the data you input.

Let’s talk about how to use your budget as a tool to stay on track and grow sustainably.

Harvesting Strawberry Ice dinner-plate dahlias reminds us that with the right care and planning—whether in the field or in the books—beautiful results follow.

Bookkeeping is the foundation for a thriving flower farm. By staying organized, leveraging the right tools, and regularly reviewing your financial reports, you can make informed decisions that keep your business growing season after season.

Remember, your books don’t have to be perfect—they just need to work for you.

If you’re ready to take the next step in managing your flower farm’s finances, check out our budgeting blogs tailored to different stages of your flower farming journey:

For First-Year Flower Farmers:

How to Budget for Your First Year of Flower Farming

For Second-Year Flower Farmers and Beyond:

Budgeting for Flower Farmers: Second Year and Beyond

With the right systems in place, you’ll not only reduce stress but also set your farm up for long-term success.

Happy bookkeeping!

We are looking forward to sharing more blooms with you soon.

Graham & Jessica

Join Us on May 12th, 2025, for ASCFG Ask the Experts!

We’re thrilled to be guest speaking on online bookkeeping as part of the Association of Specialty Cut Flower Growers (ASCFG) Ask the Experts series! Whether you're just getting started or looking to streamline your current system, we'll be sharing practical tips and insights to help keep your flower farm’s finances in top shape.

This session is exclusive to ASCFG members, so be sure to sign up today to secure your spot! We can't wait to see you there!